As electric mobility reshapes transportation, it is simultaneously redefining the way drivers pay for energy on the road. Plug & Charge, a standard defined by ISO15118, is rapidly emerging as the frontrunner for EV charging payments in the 2030s. By securely linking the EV directly to the charger and enabling automatic authentication and billing, Plug & Charge offers a leap beyond RFID cards, apps, or contactless terminals.

Unlike Autocharge (which uses MAC addresses and lacks fraud resistance), Plug & Charge operates via Public Key Infrastructure (PKI), leveraging digital certificates, TLS encryption, and vehicle-based contract certificates. This enterprise-grade framework enables secure and seamless charging while allowing for enriched data exchange, including vehicle-to-grid (V2G) participation.

Current barriers to adoption

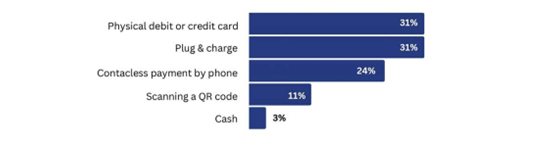

Despite strong driver demand (Figure 1) and growing OEM support (15+ major carmakers already onboard), only a small fraction of charging sessions use Plug & Charge today. The bottleneck lies in ecosystem readiness: widespread CPO upgrades are ongoing, but many EVs on the road were not factory-equipped with Plug & Charge. Hubject estimates 3 million Plug & Charge-enabled vehicles in Europe today, with 100% new EV compatibility projected by 2030.

Figure 1: Anticipated payments innovation according to EV drivers

Payment models are being rewritten

Plug & Charge introduces the vehicle as a payments actor, which disrupts the traditional open-loop (card schemes) and closed-loop (roaming via eMSPs) models. It raises critical questions: Who provides the payment credentials embedded in the vehicle? Who settles the transaction?

Three models are emerging:

- MSP Credentials over the Cord: Mirrors today’s roaming networks (e.g., Hubject, Gireve), but lacks real-time authorisation and broad interoperability.

- Payment Schemes over the Cord: Card-based credentials issued by banks. This approach promises global interoperability, online authorisation, and integration with standard banking statements.

- OEM ID over the Cord: OEMs embed their own user IDs in vehicles. While offering deep vehicle data integration, this model faces challenges related to fragmentation and limited scalability.

Race for ownership: who will win the Plug & Charge payment layer?

Early signs suggest card schemes and eMSPs are best positioned to compete for dominance. Card schemes bring robust infrastructure, global interoperability, and deep expertise in security and transaction settlement. They are uniquely equipped to extend existing four-corner models into the vehicle ecosystem with minimal friction. eMSPs, on the other hand, already operate the dominant model for EV charging today through roaming networks and have established commercial relationships with CPOs and fleet operators. They are positioned to evolve their platforms to support Plug & Charge certificates and leverage their customer bases.

OEMs, while technically capable of embedding and managing the authentication layer within the vehicle, face structural disadvantages in scaling payment acceptance. Unlike schemes or eMSPs, OEMs are not experienced payment institutions, nor are they incentivised to take on transaction risk or complex compliance obligations such as AML/KYC. Instead, their strategic focus is likely to pivot toward monetising rich vehicle data, enabling value-added services such as predictive maintenance, personalised charging offers, or usage-based insurance. Some OEMs may experiment with direct payment channels or proprietary ecosystems. Still, the lack of interoperability and regulatory burden will likely deter them from leading payment settlement across a fragmented infrastructure. As a result, they may opt to partner with payment specialists while retaining control over the in-vehicle experience.

A public key infrastructure for EVs

To support a scalable and secure Plug & Charge ecosystem, the European Commission proposed a Multi-Root PKI framework in 2023. This regulated architecture, including a Certificate Trust List (CTL), would ensure interoperability between different certificate authorities, eliminating one of the key pain points of today’s roaming systems.

Strategic implications for payments players

Plug & Charge opens new ground for innovation in payment processing, reconciliation, and customer experience. It invites scheme providers, acquirers, issuers, and fintech platforms to rethink roles, data ownership, and value creation. As in-car payments mature, seamless authentication, transaction transparency, and secure certificate handling will be the benchmarks for success.

In a rapidly electrifying world, the payments industry must now think not just about the point of sale, but the point of connection.

Download the full PaymentGenes whitepaper.

About the author

Bas van Donselaar is a financial services and payments expert with a serious knack for all things innovative and growth-related. Currently at the helm of the Consultancy team and Banking, FinTech & Mobility Practice at PaymentGenes, his mission is to help client teams and leaders ride the wave of the ever-evolving payments landscape. His background at Mastercard and boutique consultancy firm IG&H gave me a deep understanding of the payments ecosystem and a broad view on financial services at large.

About PaymentGenes

PaymentsGenes is an Amsterdam-based professional services firm dedicated to payments with business lines in Consultancy, M&A, Talent Solutions and the PaymentGenes Academy. We accelerate growth in the fast-paced payments & FinTech ecosystem. Executed with a smile and delivered with a personal touch.