Insights from mpe 2025 – key highlights and trends

Irina Ionescu

07 Apr 2025 / 5 Min Read

mpe 2025 opened its doors on a crisp March morning, inviting over 1,500 attendees to engage in a three-day event filled with discussions around the latest developments and technologies in payments. This year, the event gathered more than 160 speakers across the stages, sharing insights into payments, Open Banking, payment orchestration, AI, cybersecurity and fraud prevention, digital wallets, network tokenization, stablecoins, regulations, and more.

As long-term media partners of mpe, The Paypers couldn’t miss the opportunity to meet with industry specialists and learn more about pressing matters and pain points for merchants, as well as providers’ new capabilities and solutions targeted to making the payments industry safer for everyone.

Merchant payment trends in 2025

As ecommerce gains more traction with consumers, merchants face new challenges in implementing the right tools and technologies to make the shopping process as smooth as possible, increasing conversion rates, reducing cart abandonment, all while also fighting fraud and chargebacks.

We identified six main trends that were explored during this year’s panels at MPE Berlin – artificial intelligence (AI), regulations, fraud, digital currency payments, merchant payment strategies, and SmartPOS, so let’s take a closer look at what to expect in the following months.

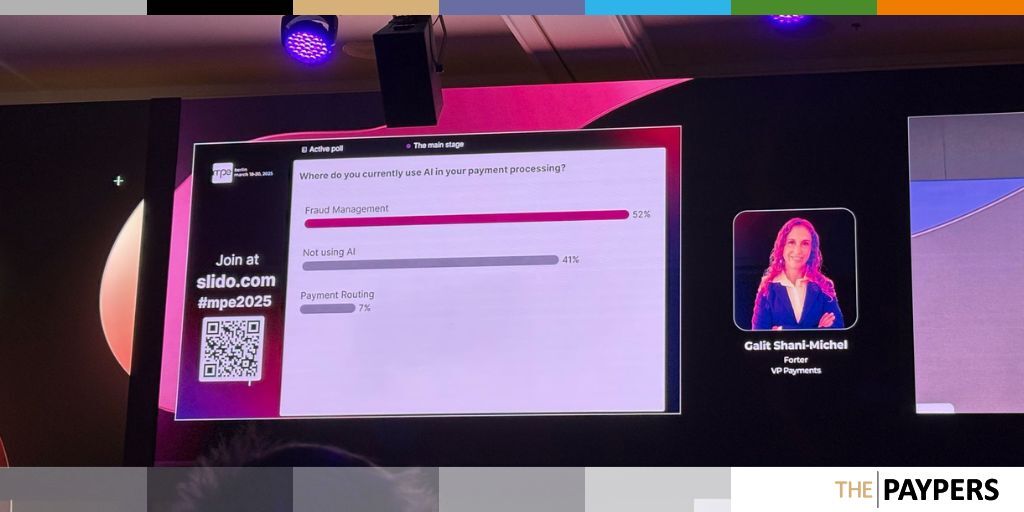

The importance of AI and data in driving success

One of the dominant topics this year was the rising adoption of AI models. In a panel featuring experts from Forter, Thoughtworks, Douglas, PCI Security Standards Council, and Gefferie Group, participant merchants were asked to mention during which stage of the payment processing they were using AI, with 52% of respondents claiming they use it for fraud management, and only 7% for payment routing. Surprisingly, more than 40% mentioned they do not use AI at all, showcasing a significant difference between the perception of using AI and integrating a trend into the actual payment infrastructure.

However, successfully integrating AI tools into the payments and fraud prevention structure goes beyond the model itself. For AI to become a helpful tool in automating daily activities and even providing qualitative feedback in more complex situations, the model behind needs to be fed with qualitative data. One aspect that was heavily discussed during this panel at mpe Berlin was the duality of AI – a useful tool for companies looking to optimise their processes and streamline revenues, as opposed to its utility in the hands of cybercriminals. Unfortunately, fraudsters have become more successful than companies when it comes to integrating AI into their schemes, going as far as inserting backdoor-ridden codes to steal sensitive data for professionals looking to ease their daily jobs, without paying attention to the risks of using open-source AI models.

The solution? Orchestrators can optimise payment processes by leveraging AI-driven data only if the data they have access to is accurate and qualitative. Without a doubt, AI and machine learning (ML) will play a crucial role in shaping the landscape of future payments but their success will still heavily depend on humans making sure they are used for the right purposes.

How to fraud-proof your business?

Fraud and payments are two pieces of the same ecosystem, and merchants must be open to a holistic approach to successfully tackle both. This year, merchants’ focus was on friendly fraud and chargebacks, as customers continue to have an increased appetite for ordering online and are developing unruly behaviours to shop more and pay less.

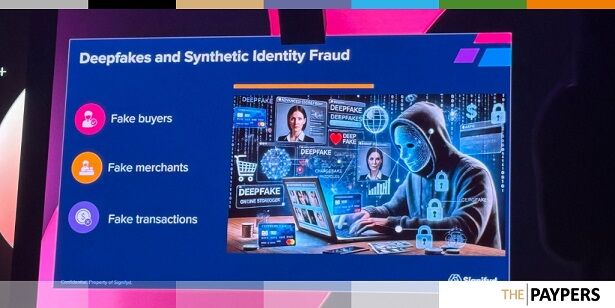

In a panel moderated by Andre Moeller from Volkswagen Group Charging, experts from Visa, MRC, Signifyd, and Justt discussed strategies to improve authorisation rates and reduce chargebacks, identifying and mitigating risks with AI (GenAI, deepfakes, scams), as well as leveraging Visa and Mastercard’s initiatives for reducing chargebacks and increasing first party trust.

Fraud affects merchants during each step of the payment process, from onboarding to transaction disputes. And, apart from chargebacks and friendly fraud, merchants now face a series of threats attributed to each step of the process, from abuse schemes to triangulation fraud, and AI-driven attacks. Thus, balancing automation and human intelligence is crucial to reduce operational risks and strengthen defences, so integrating ML and AI-driven programmes into the fraud prevention strategy could lower chargeback rates and potentially stop fraud at the door.

Regulatory updates

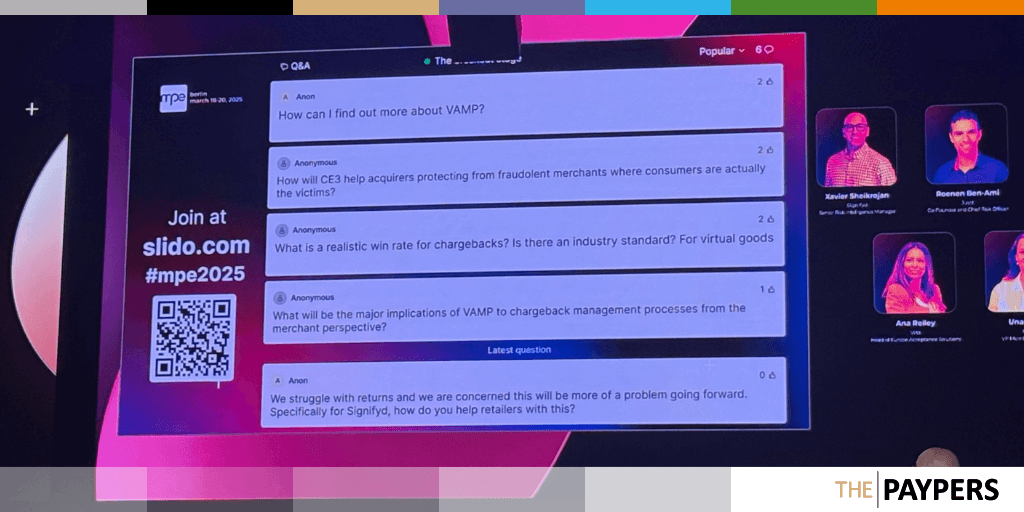

Protecting payments means merchants must be compliant with the latest regulatory changes in the international market. Upcoming PSD3, Visa’s Acquiring Monitoring Program (VAMP), CCD2, and the (redundancy) of 3DS were among the hottest topics discussed at Berlin. While regulatory bodies push for more transparency, more customer protection, and more data sharing, merchants view the web of laws and compliances differently.

Visa’s upcoming VAMP has left many merchants wondering about the effects of the programme towards them, as they requested more clarity on what will change. Moreover, Visa recently announced it has extended the advisory period for the programme, which became effective on 1 April 2025, until 30 September 2025. Developed in order to reduce fraudulent activities and the number of chargebacks, VAMP will most likely have a stronger impact on merchants from the US and other non-regulated territories, as a similar initiative already echoed in the EU under PSD2, mandatory SCA (strong customer authentication), and 3DS.

Discussing with merchants across various verticals (retail, luxury, travel, etc.) improved our understanding about the regulation ecosystem and the fact that not all merchants are impacted the same when it comes to these changes. While solution providers and banks vet for the importance of using 3DS for preventing fraud in general, chargebacks can still get through.

Some merchants activating in luxury retail mentioned that implementing 3DS will not limit chargebacks but, instead, will reduce the rate of conversed payments as it adds an extra layer of friction for the user. Therefore, balancing the right fraud prevention tools while maintaining high customer satisfaction rates is crucial for business.

On the other hand, merchants from other sectors, including retail and travel, discussed the importance of 3DS in their fraud prevention strategy and its success in fighting CNP fraud, identity fraud, and stopping most of the chargebacks. However, it is important to mention that chargebacks are often initiated for reasons other than fraud, which include customers dissatisfied with the service, delivery details, failure to receive the product, or failure to recognise a transaction.

The overall success of the authentication protocol developed by EMVCo and supported by major card schemes led to changes in Japan’s regulatory environment also, as of 1 April 2025 all merchants in this country must implement 3DS for their online transactions.

Ultimately, the global regulatory landscape is shifting towards providing more protection to the customer, and recent initiatives create the perfect ground for lucrative debates between frictionless payments, customer satisfaction, and fraud prevention. Forums like mpe Berlin favour merchant, banks, and PSPs networking, as all three are important parts of the payment infrastructure and must create a safe and secure environment for ecommerce.

Digital currency payments

In 2024, the monthly transaction volume for stablecoins was estimated at USD 450 billion, about half of what Visa processes each month and, with Stripe, PayPal, and Visa making investments in the space, the topic has been gaining more momentum. From a merchant perspective, stablecoin payments come with several benefits spanning real-time settlements and transparency, and cost efficiencies however, the complexity of integrating stablecoin payments is still a point of conjecture.

Central bank digital currencies (CBDCs) are also a trending topic, with several central banks announcing plans to launch CBDCs driven by varying reasons. In Europe in particular, the digital euro initiative has opened new discussions about challenging the current European payments network and its over reliance on foreign card schemes. It comes, thus, as no surprise that digital currency payments made it into the mpe Berlin’s agenda this year.

The discussions centred around stablecoin use cases for B2B cross-border payments, treasury settlements, payment acceptance, and B2C payouts, as well as integration challenges. In the context of stablecoins and the digital euro, the discussion also covered the idea of programmability and privacy concerns, as well as regulatory oversight.

Merchant payment strategies

Another topic discussed at mpe Berlin in 2025 was modular payments. Just like in other industries beforehand, payments are now seen as a shift away from rigid legacy systems towards more flexible, customisable payment setups that give merchants more control over their payments infrastructures.

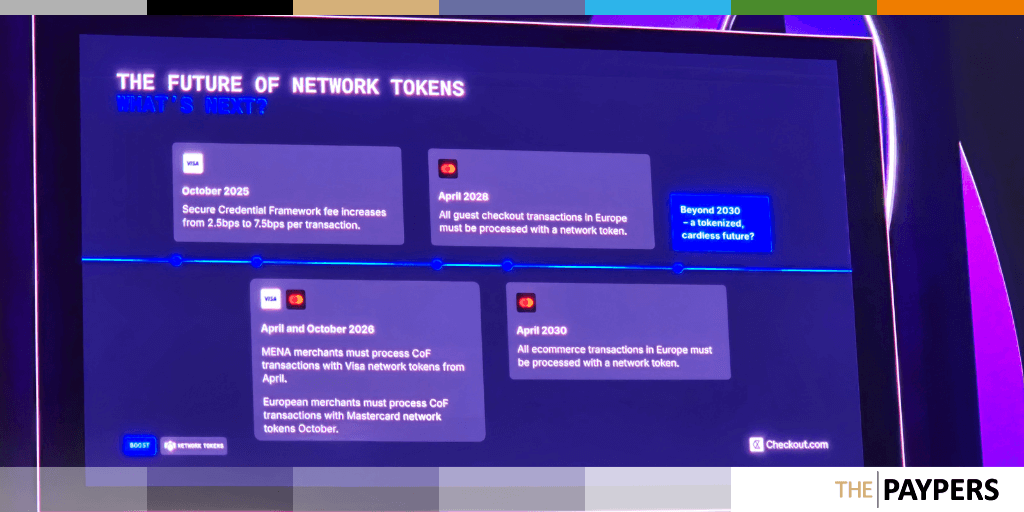

Tokenization was also a recurrent topic, with an entire panel discussion dedicated to it. While merchants are increasingly implementing network tokens in light of the several benefits they offer, from increased security to reduced fraud, several impediments still exist. As such, adoption issues still make it impossible for merchants to leverage strategies that completely rely on network tokens. With issuer adoption varying across geographies and significant variations in performance, one issue lies in the fact that some issuer risk models are not set up to treat network tokenized transactions as high trust and, on the contrary, favour raw PAN transactions. Therefore, monitoring the level of tokenization support at issuer level, as well as the performance of tokenization when it gets to the authorisation stage to check for increases in authorisation becomes a key concern for merchants, as it can help them better decide when to use tokens vs. raw PANs.

In light of Mastercard’s recent announcement of its plans to phase out the traditional 16-digit card numbers and the dominance of card payments, tokenization is a topic that will most likely continue to be discussed.

SmartPOS for a loyalty-driven era

Customer loyalty and personalisation are concepts that, in the world of payments, are usually associated with ecommerce transactions, but not as much with point of sale (POS) ones. However, with recent data showing that 94% of new ordered payment terminals in Europe are Android-based SmartPOS devices, it is a clear signal that merchants favour newer, more flexible payment POS solutions and that legacy POS terminals are being left behind.

At mpe Berlin 2025, one panel exclusively centred around SmartPOS devices being underused for customer engagement and loyalty and what the future might hold. The future of SmartPOS devices and loyalty could include placing orders via POS devices, recognising recurrent customers, offering real-time discounts at checkout, displaying ads, and even initiating loyalty programme onboarding. That being said, the future applications of SmartPOS for loyalty hinge on merchant profiles and how easy they are to integrate, the latter still being a common pain point for many merchants.

In terms of what the future holds, payment experts argue that while we may not see immediate changes in the POS payment landscape, a future where loyalty and POS devices come together is likely to occur. At the same time, in the long run, traditional hardware POS devices may become less common as mobile app-based POS services gain popularity.

A night into the making

mpe Berlin is a great place for industry enthusiasts to share thoughts, insides, and network. And what better way to do so if not over a celebratory night? On the second night of the event, attendees are invited to the mpe Awards gala dinner, where they can celebrate the success of fellow companies and their innovative solutions in the payments sector. Here are this year’s categories and their winners:

-

Merchant Payment Acceptance of the Year: Market Pay

-

Most Innovative Payment Solution: Paynt

-

Best Use of Data Analytics: Celeris

-

Best Cross Border Merchant Solution: BVNK

-

Best Use of Open Banking for Payments: Brite Payments

-

Best RegTech Solution: Vixio Regulatory Intelligence

-

Best OmniChannel Payments Solution: Lloyds Banking Group

-

Best Marketplace/Platform Provider: Mangopay

-

Most Innovative Fraud Prevention Solution: Riskified

-

Best Payments Orchestration Solution: BR-DGE

-

Best Embedded Finance / BaaS Solution: Unipaas

-

Best startup innovation award: Securely Group

-

Chairman's Award/ Best ESG Initiative in Payments: Greenspark

-

MPE Influencer of the Year: Kamil Hanacek

Conclusions

As the payments industry continues to evolve, it is highly important for specialists and enthusiasts alike to nurture a strong community that can share developments and address challenges in real-time. Merchants and solutions providers alike were keen on learning more about upcoming regulations and how to remain compliant, so, over the next months, we will aim to bring more clarity onto these topics of interest and further educate our readership.

mpe Berlin 2026, we’re ready for you!

About Irina Ionescu

Irina is a Senior Editor at The Paypers, specialising in fraud and online payments. Leveraging her Ph. D. in Economics and a strong economic academic background, she constantly observes new developments in tech, innovation, and regulation, educating the audience about trends in fraud prevention, chargebacks, scams, social engineering, digital identity, GenAI, and ecommerce. You can reach out to her via LinkedIn or email at irina@thepaypers.com.

Irina is a Senior Editor at The Paypers, specialising in fraud and online payments. Leveraging her Ph. D. in Economics and a strong economic academic background, she constantly observes new developments in tech, innovation, and regulation, educating the audience about trends in fraud prevention, chargebacks, scams, social engineering, digital identity, GenAI, and ecommerce. You can reach out to her via LinkedIn or email at irina@thepaypers.com.

About Diana Lupuleac

Diana is an experienced and dedicated Senior Editor at The Paypers. She has an extensive background in content creation and is a graduate of Foreign Languages and Literature studies, currently specialising in payments and ecommerce. She strives to bring forward the latest trends for our readers, while investigating the ever-evolving landscape of cross-border payments, B2C and B2B ecommerce, and emerging technologies across the globe. Diana can be reached via email at diana@thepaypers.com or on LinkedIn.

Diana is an experienced and dedicated Senior Editor at The Paypers. She has an extensive background in content creation and is a graduate of Foreign Languages and Literature studies, currently specialising in payments and ecommerce. She strives to bring forward the latest trends for our readers, while investigating the ever-evolving landscape of cross-border payments, B2C and B2B ecommerce, and emerging technologies across the globe. Diana can be reached via email at diana@thepaypers.com or on LinkedIn.

Irina Ionescu

07 Apr 2025 / 5 Min Read

The Paypers is a global hub for market insights, real-time news, expert interviews, and in-depth analyses and resources across payments, fintech, and the digital economy. We deliver reports, webinars, and commentary on key topics, including regulation, real-time payments, cross-border payments and ecommerce, digital identity, payment innovation and infrastructure, Open Banking, Embedded Finance, crypto, fraud and financial crime prevention, and more – all developed in collaboration with industry experts and leaders.

Current themes

No part of this site can be reproduced without explicit permission of The Paypers (v2.7).

Privacy Policy / Cookie Statement

Copyright